Project Overview:

The venture’s goal was to produce 2.7 million tonnes of thermal coal per annum and include a coal handling and preparation plant to support infrastructure and services.

The project started in November 2017, finished ahead of schedule and was handed to operations in February 2020. The project was completed within the approved budget.

Exxaro’s new Belfast Coal Mine is producing high-grade thermal coal

The R3.3 billion Belfast project, and first-of-its-kind digital mine, is centred on the last A-grade, high-yield coal deposit in Mpumalanga. The project was an opportunity to show the progress of digitalisation in mining, creating jobs, upskilling employees, promoting sustainability and further developing Exxaro’s solid reputation.

The LOM (life of mine) of the Belfast mine was 17 years – for the first phase – making it a high value-add coal project in the Mpumalanga region and greater South Africa as it bolsters the local coal business. The LOM has since been adjusted downwards to 11 years. A potential second phase could take Belfast’s LOM to 2043.

The Belfast plant primarily produces A-grade, export-quality coal (typical 6000 kcal/kg) at a projected volume of 2.2 million tonnes per annum (MTPA) and a secondary-quality product (typical 21.5 MJ/kg) for local use or export of approximately 0.5 MTPA.

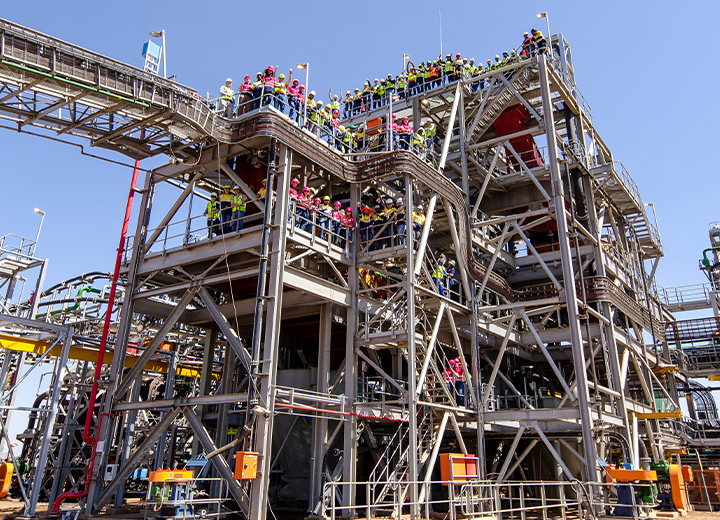

With over 20 years in development, Belfast Coal is a digital and connected mine, pushing boundaries towards real-time decision-making and productivity improvement through remote monitoring and tracking of all devices and performance data. The project achieved 5517 million lost time injury (LTI) free hours.

With the strong focus on benefitting the community of Nkangala District Municipality in Mpumalanga, over 6000 direct and indirect jobs were created during construction, seeing almost 20,000 people benefitting. The project is expected to contribute R39 billion to local GDP over the life of the mine, with the district’s GDP gaining an estimated R2.1 billion per annum, including R966 million – a full 1% increase – of a direct impact on the municipality.